The global energy landscape is shifting rapidly. For businesses operating in construction, outdoor events, or remote industrial sites, the traditional reliance on diesel generators is no longer the only—or even the best—option. As sustainability mandates tighten and fuel prices fluctuate, many project managers are turning to mobile energy solutions. Specifically, understanding the ROI for battery storage rental has become a critical task for financial officers and site engineers alike.

In this context, companies like Foxtheon are leading the charge, providing modular and efficient battery systems that allow businesses to transition toward greener power without the heavy upfront costs of purchasing hardware. But how do you actually measure the return on such an investment when you aren’t “owning” the asset?

The Shift from CAPEX to OPEX in Energy

For years, the standard approach to energy storage was a Capital Expenditure (CAPEX) model. You bought the battery, you owned it, and you depreciated it over ten years. However, in a fast-moving technological field, this carries significant risk. Technology becomes obsolete, and maintenance remains your responsibility.

By shifting to an Operating Expenditure (OPEX) model through rental, the financial equation changes. The ROI for battery storage rental becomes much easier to justify because the costs are directly tied to project timelines. You only pay for the energy capacity you need, exactly when you need it, avoiding the “idle asset” trap where expensive equipment sits in a warehouse during off-seasons.

Avoiding Technology Obsolescence

Battery technology, particularly Lithium Iron Phosphate (LFP) chemistry, is advancing every year. A unit purchased today might be 20% less efficient than a model released in three years. When you opt for a rental, you effectively outsource the risk of obsolescence to the provider. This ensures your project always utilizes the latest high-efficiency systems, which inherently improves your operational ROI.

Preserving Cash Flow for Core Operations

Cash is king in the industrial sector. Tying up half a million dollars in a fleet of battery units might restrict your ability to bid on new contracts or hire skilled labor. Rental allows for “pay-as-you-go” energy, keeping your balance sheet lean and your credit lines open for other growth opportunities.

Direct Cost Savings Driving ROI for Battery Storage Rental

The most immediate impact on your bottom line comes from the displacement of expensive, carbon-heavy fuels. If you are currently running diesel generators 24/7, your costs include fuel delivery, rising pump prices, and constant mechanical servicing.

Eliminating Diesel Inefficiency

Diesel generators are notoriously inefficient when running at low loads. If a construction site only needs a small amount of power overnight for security lights and telematics, a large generator will still consume a significant amount of fuel just to keep the engine turning.

A battery storage system handles these low-load periods silently and efficiently. By using the battery during low-demand hours and only running the generator to fast-charge the battery at peak efficiency, you can reduce fuel consumption by up to 60%. This massive reduction in “cost-per-kilowatt-hour” is a primary driver of the ROI for battery storage rental.

Peak Shaving and Utility Bill Optimization

For grid-connected sites, demand charges can make up a huge portion of the monthly utility bill. These charges are based on the highest amount of power used during a short interval. Battery rentals allow for “peak shaving,” where the battery discharges during those high-demand moments to keep the grid draw below a certain threshold. The savings on utility penalties alone can often cover the monthly rental cost of the battery unit.

Operational Flexibility and the Foxtheon Advantage

When discussing smart energy solutions, the “hardware” is only half the story. The software and the ability to scale are what define modern efficiency. Foxtheon has recognized this by developing systems that are not only rugged but also intelligently managed.

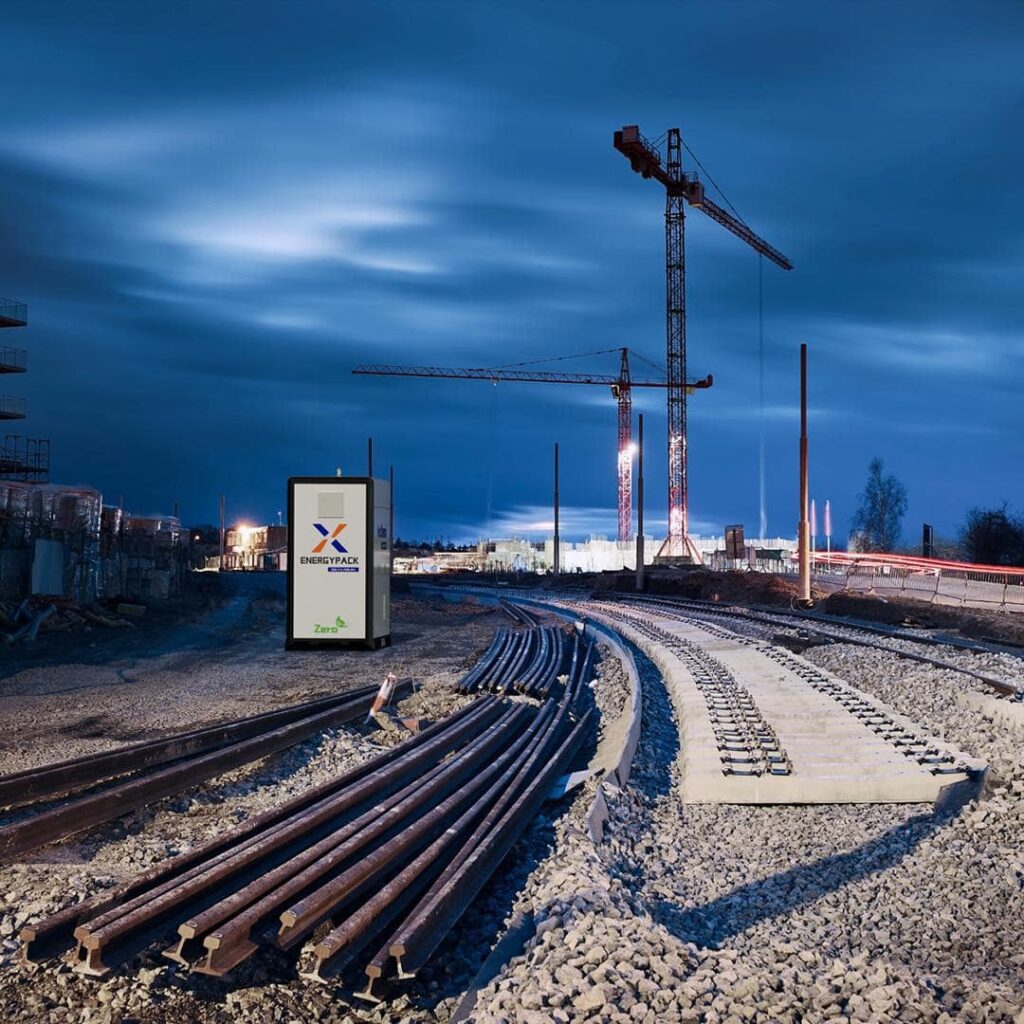

Their mobile energy storage units are designed for rapid deployment, which reduces the “soft costs” of setup and labor. When the installation of an energy system takes hours instead of days, the project’s overall timeline accelerates, contributing positively to the ROI for battery storage rental.

Reducing Maintenance and Logistics Overheads

One of the hidden killers of ROI is maintenance. Diesel engines have filters, oil, belts, and cooling systems that fail. Batteries, being solid-state technology, have virtually no moving parts. When you rent, the rental company handles the periodic firmware updates and health checks. This lack of downtime is a “silent” profit maker; every hour a site stays powered without a mechanic’s intervention is an hour of pure productivity.

Scaling Power to Match Project Phases

Construction projects have varying power needs. The foundation phase might need very little power, while the fit-out phase requires heavy lifting and multiple power tools. A rental model allows you to swap a 50kWh unit for a 200kWh unit as the project scales. You aren’t stuck with a system that is either too small (causing outages) or too large (wasting money).

Environmental Impact and the “Green” Premium

We can no longer ignore the financial value of sustainability. Many government tenders and private contracts now include “carbon ceilings.” If your project exceeds a certain emission level, you may face fines or be disqualified from future bidding.

Carbon Credits and ESG Compliance

Using battery storage reduces your carbon footprint significantly. In some jurisdictions, this can be converted into carbon credits or tax incentives. Even without direct subsidies, the ability to market your project as “CO2-neutral” or “low-noise” can allow you to charge a premium for your services. For instance, film productions or urban events often pay more for “silent power” solutions to avoid noise complaints and local council fines.

Meeting Local Noise Ordinances

In many cities, diesel generators are banned during nighttime hours. Without a battery solution, work would have to stop at 6:00 PM. By utilizing a battery rental, work can continue around the clock in silence. The ROI here isn’t just about saving fuel; it’s about the extra 10 hours of productivity gained every single day.

Key Metrics to Track Your Investment Return

To truly understand the ROI for battery storage rental, you need to look beyond the monthly invoice. You should track specific Key Performance Indicators (KPIs) to see the real-world impact on your budget.

Fuel Displacement Ratio: How many liters of diesel did you save compared to the previous month or a similar project?

Generator Run-Time Reduction: Reducing a generator’s run time from 24 hours to 4 hours a day extends the generator’s life and slashes service intervals.

Downtime Avoidance: Calculate the cost of labor standing idle during a power outage. If the battery prevented even one outage, it might have paid for itself for the entire month.

Energy Throughput Cost: Compare the cost of charging the battery (via solar or off-peak grid) against the cost of generating that same power via diesel.

Calculating the Numbers: A Simple Framework

While every site is different, the formula for calculating the ROI for battery storage rental usually looks like this:

ROI = (Total Savings – Rental Costs) / Rental Costs

Where “Total Savings” includes:

Reduction in fuel costs.

Elimination of generator servicing and oil changes.

Avoidance of peak-demand utility charges.

Labor savings from reduced fueling and maintenance logistics.

Potential carbon credit or tax incentives.

In many industrial applications, businesses see a “break-even” point within the first few months of a long-term rental, especially when fuel prices are high.

The transition to clean energy is inevitable, but the path to get there doesn’t have to be paved with high-risk capital investments. The ROI for battery storage rental offers a compelling argument for businesses that value flexibility, cash flow, and operational efficiency.

By partnering with experts like Foxtheon, companies can access the latest in smart energy technology, ensuring they remain competitive in an increasingly “green” economy. Whether it’s shaving off peak demand charges or silencing a construction site at night, the financial benefits of battery rentals are clear, measurable, and highly scalable.

Frequently Asked Questions (FAQ)

Q1: How does battery storage rental improve ROI compared to diesel generators?

A1: The primary improvement in ROI for battery storage rental comes from fuel savings and reduced maintenance. Diesel generators are inefficient at low loads, consuming high amounts of fuel for minimal output. Batteries can handle low-load periods or work in tandem with generators to ensure the engine only runs at its most efficient “sweet spot,” reducing fuel consumption by up to 60% and significantly extending service intervals.

Q2: Can I integrate solar panels with a rented battery storage system?

A2: Absolutely. Most modern units, like those provided by Foxtheon, are designed to be “plug-and-play” with renewable sources. By charging the battery with free solar energy during the day and discharging it at night, your ROI improves even further as your “fuel” cost effectively drops to zero.

Q3: Is maintenance included in the rental cost?

A3: Generally, yes. One of the major benefits of the rental model is that the provider is responsible for the equipment’s health. This removes the risk of unexpected repair bills from your balance sheet, making your project’s energy costs predictable and stable, which is essential for accurate ROI forecasting.

Q4: What happens if my power needs change mid-project?

A4: Rental offers the ultimate flexibility. Unlike a purchased system that you are stuck with, a rental allows you to scale up or down. If your site needs more power as construction progresses, you can simply request a larger unit or add modular battery packs, ensuring you only pay for the capacity you actually use.

Q5: How do “peak shaving” capabilities affect the ROI for battery storage rental?

A5: On grid-connected sites, utilities charge high fees for short bursts of high energy usage (peak demand). A battery can be programmed to discharge during these peaks, lowering the maximum draw from the grid. In many cases, the reduction in these demand charges on the monthly utility bill can be enough to offset a significant portion of the battery’s rental cost.